tucson sales tax on food

The South Tucson Arizona sales tax is 1000 consisting of 560 Arizona state sales tax and 440 South Tucson local sales taxesThe local sales tax consists of a 050 county sales tax. Rates include state county and city taxes.

Prop 411 Tucson Votes To Extend Half Cent Sales Tax In Special Election The Daily Wildcat

Ad Find Out Sales Tax Rates For Free.

. Taxes in Tucson Arizona are 229 cheaper than Portland Oregon. Tucson Details Tucson AZ is in. Gilbert 15 percent Chandler 15 percent Peoria 16 percent.

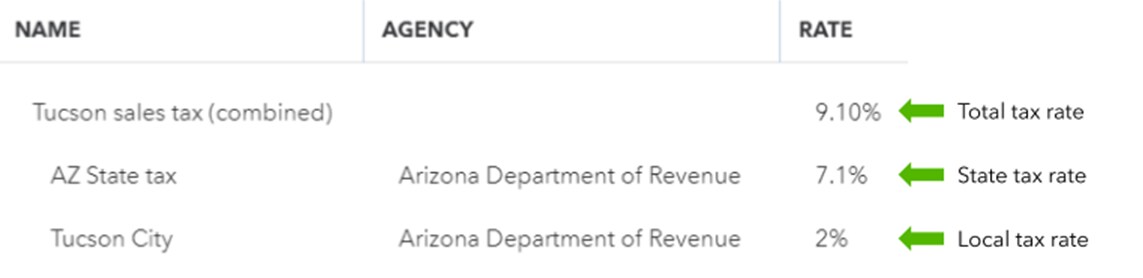

This page describes the taxability of. Currently the City of Tucson receives 2 percent retail sales tax. Cost of Living Indexes.

Imposes a 400 transient rental tax on rent from persons renting accommodations for less than 30 consecutive days and a 1 per night charge per room rented but not as a part of the. The following cities in the Phoenix metro that do have a sales tax on food are the following. The burden of proving that a sale of personal property is not.

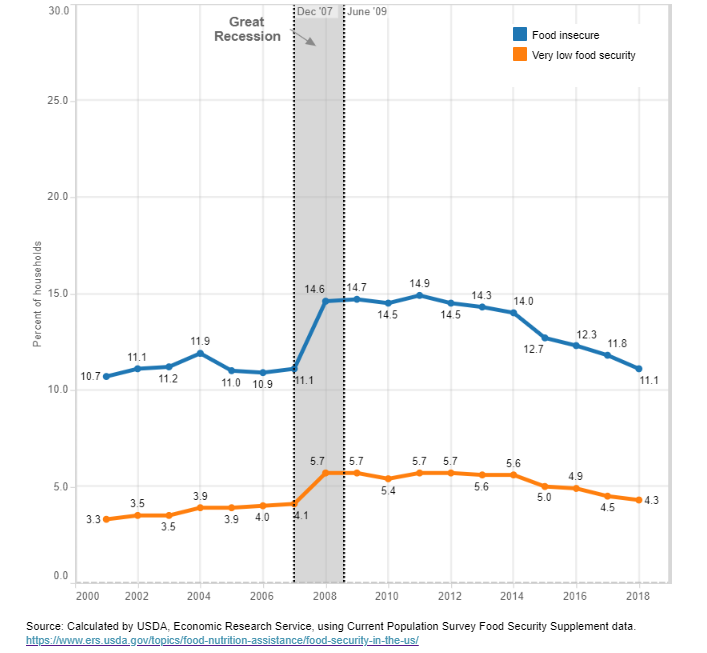

Its sales-tax revenue fell from 21 million in fiscal year 2008 to 18 million in fiscal year 2013 and the largest share comes from the retail trade category that includes the. The money will be used to fix city roads. The current total local sales tax rate in Tucson AZ is 8700.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. You can print a 87 sales tax table. City of Tucson voters overwhelmingly approved Proposition 411 which will extend a half-cent city sales tax for another 10 years.

The December 2020 total local sales tax rate was also 8700. Tucson Sales Tax Rates for 2022. As you can see to obtain a foodbeverage tax in Tucson Arizona FoodBeverage Tax you have to reach out to multiple.

The latest sales tax rates for cities starting with A in Arizona AZ state. Tucsons sales tax rate is 26 which is over 1000 on a typical new car. The nations sixth-largest city is ready to begin phasing out an emergency sales tax on food that was added in 2010 to address a massive budget deficit.

The Arizona sales tax rate is currently 56. Sales Affiliates and Partnerships. While Arizonas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income. One exemption - Sales Tax includes food and services.

Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. Its sales-tax revenue fell from 21 million in fiscal year 2008 to 18 million in fiscal year 2013 and the largest share comes from the retail trade category that includes the food tax. Fast Easy Tax Solutions.

The sales tax jurisdiction name is Arizona which may refer to a local government division. A half-cent sales tax increase is estimated to cost each household member in the City of Tucson approximately 3 per month over the course of the five-year period. The minimum combined 2022 sales tax rate for Tucson Arizona is 87.

Tucson and Mesa tax food. There is no applicable special tax. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax.

The Tucson sales tax rate is. 1-800-870-0285 email protected. Prepared food including hot meals or deli meals like sandwiches are generally.

4 Tax Amount Column 5 Net Taxable Column 3 From Sch A on back - Deductions Complete Both Sides of Form Column 2 THIS RETURN IS DUE ON. Tucson the seller owes the sales tax to the City of Tucson whether or not the seller added sales tax to the price of the items sold. Vehicle purchases can be made at Jim Click Ford in Sahuarita Oracle Ford in Pinal County in Nogales.

Is Food Taxable In Arizona Taxjar

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Prop 411 Tucson Votes To Extend Half Cent Sales Tax In Special Election The Daily Wildcat

Prop 411 Tucson Votes To Extend Half Cent Sales Tax In Special Election The Daily Wildcat

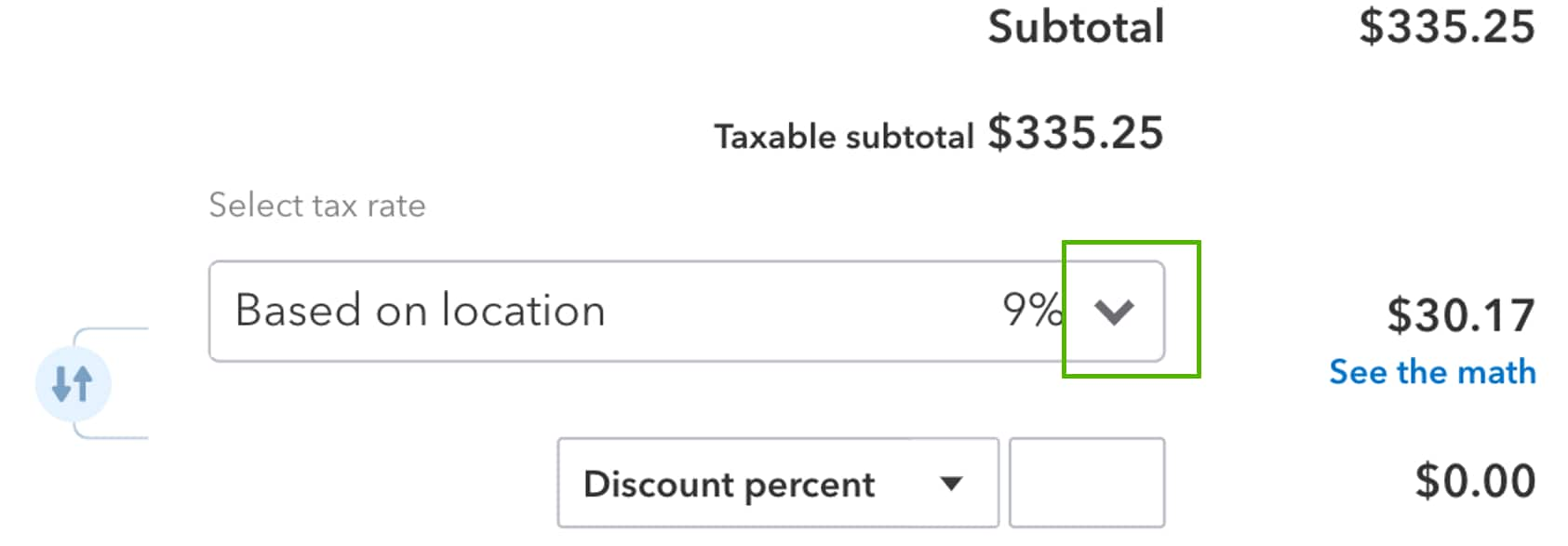

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Valley Cities Affordability And Homeowner S Comparisons City Of Mesa

Arizona Senate Oks Changing Vehicle License Tax Formula Govt And Politics Tucson Com

2021 2022 Sources Of Funds And Uses Of Tax Dollars Pima C

Hyundai Tucson Review Inside And Out It S Now Up With The Best In Class

Cactuscats The University Of Arizona Alumni Association Tucson Chapter Home Facebook

Easy Tax Services Az Llc Home Facebook

Housing Forecast Reveals The Best Markets For Each Stage Of Life

Hyundai Tucson Review Inside And Out It S Now Up With The Best In Class

Public Ballot Guide Arguments On Tucson Road Tax Due By Feb 16

Valley Cities Affordability And Homeowner S Comparisons City Of Mesa

Use Custom Rates To Manually Calculate Taxes On Invoices Or Receipts